Ever wondered why some homeowners choose quick sales, while others opt for short sales? Knowing the differences between these two real estate options can help you make better decisions. Quick sales are fast, perfect for those who need to sell quickly. Short sales, on the other hand, involve selling for less than the mortgage to avoid foreclosure.

This article will dive into the details of quick sales and short sales. It aims to provide valuable insights for homeowners, buyers, and real estate pros. By understanding the pros and cons of each, you can make more informed choices. For a quick sale, companies like Pierre Home Buyers can help. They buy houses for cash, making the process easy. You can reach them at 617-960-8536 or visit their website for more info.

Key Takeaways

- Quick sales involve faster transactions compared to traditional home sales.

- Short sales can take several months up to a year to complete.

- Choosing a short sale may reduce the impact on credit compared to foreclosure.

- Investors often find opportunities in short sales, buying below market value.

- Understanding both processes is essential for making informed selling decisions.

Understanding Quick Sales in Real Estate

A quick sale in real estate is a smart move for sellers in a hurry and buyers looking for deals. It’s important to know what quick sales are, their benefits, and how fast they happen. This knowledge helps people navigate the property market better.

Definition of Quick Sale

The quick sale definition means selling a house fast, usually in weeks. Sellers might need cash quickly because of money problems or moving jobs. They often lower the price to get offers fast, leading to a bidding war.

Benefits of Quick Sale

Quick sales have big advantages for both sides. Sellers can sell fast and solve money issues. Buyers can buy homes cheaper than usual. The process is simpler, but buyers need ready financing to move quickly.

Timeframe for Quick Sale Transactions

The quick sale transaction timeframe is short, from weeks to a couple of months. It depends on how fast the seller and buyer are ready. Sellers can sell faster than usual, which is reassuring.

What is a Short Sale?

A short sale happens when a homeowner sells their property for less than what they owe on the mortgage. This requires the lender’s approval and usually happens when the homeowner is in deep financial trouble. This can be due to many reasons, leaving the homeowner with no equity in the property.

Definition of Short Sale

The short sale definition is about a homeowner choosing to sell their home for less than the mortgage balance. They do this with the lender’s okay. It’s often chosen to avoid the harsh effects of foreclosure, which the lender can start.

Reasons for Opting a Short Sale

There are many reasons for short sale choices. Homeowners might pick this option if they can’t afford mortgage payments anymore. Their property might be worth less than what they owe. It’s important to show financial hardship to lenders.

Benefits for sellers include avoiding the bad credit score from foreclosure. They might also get help with fees from the lender.

Impact of Market Conditions on Short Sales

The market conditions short sale situation greatly affects how common short sales are. For example, they often increase when home values drop, like after the 2008 housing crisis. When homes are worth less than what’s owed, more homeowners might choose short sales as a way out.

Quick Sale vs Short Sale: Key Differences

Knowing the differences between quick sale and short sale is crucial for your financial health. Both options help sellers in tough spots, but they have different financial implications. Let’s dive into the main points.

Financial Implications for Sellers

A quick sale lets sellers get cash fast. This can help them avoid big debts and get quick relief. Short sales, however, involve negotiating with lenders to accept less than what’s owed. This means sellers won’t make any money and face tough negotiations.

Time Duration and Complexity of the Process

Short sales take longer, often 3 to 6 months or more, depending on lender responses. Quick sales, on the other hand, can close in weeks. This makes quick sales more appealing for those wanting a fast resolution.

Credit Score Considerations

Quick sales usually don’t hurt your credit score. Short sales, however, can affect it, depending on lender reports. While better than foreclosure, a short sale still impacts your ability to borrow money.

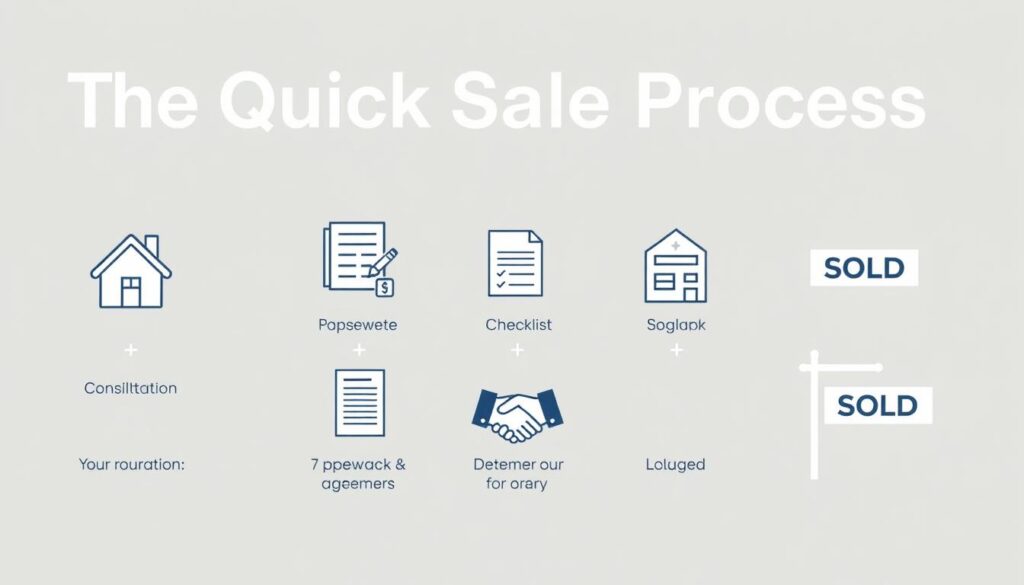

The Quick Sale Process Explained

The quick sale process is appealing to homeowners who want a fast solution in a competitive market. Knowing the steps involved can help sellers make better choices. Working with the right people is key to success.

Steps Involved in a Quick Sale

A quick sale involves important steps that focus on speed and efficiency. Here’s what happens:

- Contact cash buyers directly for quick deals.

- Compare offers based on what the seller wants and the market.

- Work out the details to make sure both sides are happy.

- Close the sale fast, often without the usual marketing.

Who is Involved in a Quick Sale?

Many important people are part of a quick sale, working together:

- Homeowners: People who need to sell fast for financial reasons or to move quickly.

- Cash buyers: Investors or companies that offer money right away, skipping the long loan process.

- Real estate agents: Experts who help with talks and paperwork, making things easier for everyone.

- Title companies: Groups that make sure the property’s ownership is clear and correct, helping the sale go smoothly.

Understanding the quick sale process and who’s involved helps homeowners manage their sales better. The main thing is to keep communication open and clear.

The Short Sale Process Explained

Understanding the short sale process is key for homeowners in tough financial spots. It involves several important steps and specific documents needed for a smooth sale.

Steps in the Short Sale Process

The journey starts when homeowners ask their lender to let them sell for less than the mortgage debt. They need to submit a hardship letter and financial documents. The main steps are:

- Writing a hardship letter: This explains why the homeowner is struggling financially, like job loss or health issues.

- Providing financial proof: Homeowners must show their current financial state with bank statements, financial reports, and bills.

- Listing the property: After lender approval, the home is listed as a short sale, attracting buyer offers.

- Reviewing offers: The lender looks over offers and might negotiate with other creditors for the seller.

Knowing these steps helps homeowners better handle this complex situation.

Documentation Required for Short Sales

Having the right short sale documents is essential for a smooth deal. Some important ones are:

- A hardship letter explaining why the sale is necessary.

- Financial statements showing the homeowner can’t afford mortgage payments.

- Tax returns from the last two years.

- Proof of income, like pay stubs or bank statements.

Lenders need these to fully understand the seller’s situation. It’s wise to talk to legal and financial experts before starting. For more help, check out article.

Advantages and Disadvantages of Quick Sales

When it comes to selling real estate, sellers have many options. Quick sales are one of them. Knowing the pros and cons helps sellers make smart choices.

Pros of Quick Sales

Quick sales are fast, which is a big plus. They let homeowners sell unwanted properties quickly. This can reduce stress from long sales processes. Other benefits include:

- Little to no repairs are needed, saving on costly renovations.

- There are fewer bureaucratic hurdles, making the process smoother.

- Sellers can get their money fast, helping with urgent financial needs.

Cons of Quick Sales

Quick sales have their downsides too. These can include:

- Lower sale prices, as buyers might not pay as much.

- Buyers may rush the sale, leading to hasty decisions.

- There’s little room for negotiation, focusing on speed over terms.

Advantages and Disadvantages of Short Sales

Short sales are a special option for homeowners in tough financial spots. It’s key to know the short sale advantages and short sale disadvantages before making a choice.

Pros of Short Sales

Short sales offer several benefits for homeowners in trouble. These include:

- Avoiding foreclosure: Homeowners can dodge the bad effects of foreclosure on their credit scores.

- Financial relief: A short sale can ease the heavy burden of an unaffordable mortgage.

- Legal exit strategy: Homeowners can leave their mortgage legally, making it easier to move to a better financial spot.

- Potentially faster mortgage approval: After a short sale, homeowners might get a new mortgage sooner than after a foreclosure.

- Extended stay in the home: Homeowners can stay in their home until the short sale is done, giving them a temporary break.

Cons of Short Sales

But, there are also short sale disadvantages to think about:

- Complex process: A short sale involves a lot of paperwork and takes longer than a regular sale.

- Lender approval required: Getting the lender’s okay can cause delays and uncertainty, sometimes killing the deal.

- Credit score impact: While not as bad as foreclosure, a short sale can still lower your credit score.

- Potential deficiency judgments: If the sale price is less than the mortgage, lenders might go after the seller for the difference.

- Eligibility requirements: Homeowners must show they have a valid reason for the sale, adding extra criteria.

| Short Sale Advantages | Short Sale Disadvantages |

|---|---|

| Avoids foreclosure | More complicated process |

| Offers financial relief | Lender approval required |

| Legal exit strategy | Credit score impact |

| Fast approval for a new mortgage | Potential for deficiency judgments |

| Homeowner can stay until sale finalization | Strict eligibility requirements |

Conclusion

Understanding the difference between quick sales and short sales is key for homeowners in tough financial spots. We’ve covered the main points of both, showing their unique effects. Quick sales are fast, great for urgent needs. Short sales help when the mortgage is too high, easing debt and offering good deals for buyers.

Knowing these differences helps sellers choose wisely based on their situation. Short sales can be a big win for buyers, with prices lower than market value. Plus, short sale homes usually have fewer problems than foreclosures, making the buying process easier. For those needing to sell fast, working with pros like Pierre Home Buyers can make it smoother.

In the end, knowing your options is crucial for making the right choice in real estate. Homeowners should understand the benefits and downsides of each path. This way, they can pick the option that fits their financial goals best.